Tax Brackets Explained: 5 Things You Should Know

Table of Contents

Key Takeaways

What Are Tax Brackets?

How Tax Brackets Work

Why Tax Brackets Are Essential

5 Essential Facts About Tax Brackets

1. Tax Brackets Define Income Ranges

2. Each Portion of Income Is Taxed Differently

3. Tax Brackets Adjust Periodically

4. Tax Brackets Can Benefit Low-Income Earners

5. Tax Brackets Apply to Multiple Filing Categories

6 Key Factors to Consider When Choosing a Tax Planning Partner

Frequently Asked Questions

Simplify Your Tax Planning Today with Fincadia Tax Services!

Key Takeaways

✔ Tax brackets determine how much of your income is taxed based on specific income ranges.

✔ Only the income within each bracket is taxed at that bracket's rate, not your total earnings.

✔ Tax brackets change over time due to inflation adjustments or government policy updates.

✔ Lower tax brackets help reduce the tax burden for low-income earners.

✔ Tax brackets vary depending on filing status, such as single, married, or head of household.

Understanding tax brackets and how they work is crucial for effective financial planning, yet many U.S. taxpayers remain unaware of key tax concepts. A recent survey revealed that over two-thirds of respondents did not know the top federal income tax rate, and more than half were unsure about how tax brackets function.

This lack of knowledge can lead to missed opportunities for tax savings and confusion during filing season. To help clarify these concepts, here are five essential facts about tax brackets, offering clear insights and practical advice for better tax planning.

What Are Tax Brackets?

Tax brackets are predefined ranges of taxable income. Each range corresponds to a specific income tax rate, which applies only to the portion of income within that bracket. This progressive structure ensures that higher earners pay a larger share of taxes.

Purpose of Tax Brackets: Tax brackets are designed to distribute the tax burden fairly and equitably across income levels.

How They Apply: Income is taxed progressively, with different portions subject to varying rates based on defined thresholds.

How Tax Brackets Work

Tax brackets use a progressive taxation system to ensure individuals pay taxes proportionate to their earnings. This means that different portions of an individual’s income fall into various brackets, with each taxed at its corresponding rate.

Lower Brackets Cover Initial Income: The lowest income tax rates apply to the first portion of an individual's earnings.

Higher Brackets Apply Incrementally: As income increases, only the portion exceeding the lower bracket's threshold is taxed at a higher rate.

Why Tax Brackets Are Essential

Understanding tax brackets empowers individuals to make informed financial decisions and optimize their income tax planning strategies.

Strategic Tax Planning: Knowing how tax brackets work helps individuals reduce taxable income through deductions, credits, or contributions to retirement accounts.

Accurate Tax Estimation: Awareness of income tax rates within each bracket allows individuals to estimate their tax obligations with precision.

Maximizing Deductions: Understanding brackets aids in identifying ways to lower taxable income while staying compliant with tax laws.

5 Essential Facts About Tax Brackets

1. Tax Brackets Define Income Ranges

Tax brackets are a fundamental part of income tax systems, providing a structured way to categorize income levels and calculate tax obligations. They divide taxable income into specific ranges, each subject to a corresponding tax rate. Using these brackets, governments can implement a progressive tax system, where individuals or businesses with higher earnings contribute a larger percentage of their income to taxes. This system is designed to ensure fairness and balance in tax collection, with lower-income earners typically taxed at a lower rate than those with higher incomes.

Marginal Tax Rates in Income Tax

Marginal tax rates are fundamental to understanding how tax brackets operate. Unlike flat taxation, marginal rates ensure that only the portion of income exceeding a bracket's lower limit is taxed at the bracket's rate.

Avoids Over-Taxation: Marginal tax rates prevent individuals from paying a higher tax rate on their entire income when they move into a new bracket.

Encourages Income Growth: Progressive systems with marginal rates motivate individuals to increase earnings without fear of being penalized.

2. Each Portion of Income Is Taxed Differently

Understanding how tax brackets function is essential for effective tax planning. Many assume that their entire income is taxed at the highest rate they reach, but this is a common misconception. Instead, the system is designed to apply different income tax rates to specific portions of income, ensuring a fairer distribution of tax burdens.

Key Benefits of Progressive Taxation

This system offers several benefits that impact individuals at all income levels:

Fairer Taxation: By taxing income progressively, individuals with lower earnings pay lower rates, while higher earners contribute more.

Reduced Tax Burden on Low-Income Earners: Low earners keep more of their money, making the tax system less regressive.

How To Use Tax Brackets for Tax Planning

Proper tax planning ensures taxpayers can minimize their liabilities while complying with legal requirements. Here are some strategies:

Adjust Timing of Income: Deferring income or accelerating deductions can help keep taxable income within favorable brackets.

Plan for Major Income Changes: Awareness of how income shifts impact tax brackets can guide financial decisions, such as bonuses or asset sales.

3. Tax Brackets Adjust Periodically

Tax brackets are an essential aspect of understanding income tax rates and tax planning. They define the ranges of taxable income that are subject to specific tax rates. Periodically, tax brackets change due to inflation adjustments or legislative actions by the government. These adjustments ensure that taxpayers are taxed fairly and that the system adapts to economic realities.

Inflation Adjustments

Inflation adjustments help taxpayers avoid "bracket creep," where rising wages push them into higher tax brackets even though their purchasing power remains the same. Adjustments for inflation are typically made annually.

Purpose of Adjustments: To ensure that taxpayers are not unfairly taxed due to inflation-driven increases in income.

Frequency: Adjustments usually happen yearly, aligning with changes in the Consumer Price Index (CPI).

Impact on Tax Planning: Taxpayers should stay informed about annual changes to optimize their financial strategies effectively.

Policy Changes Introduced by the Government

Governments may revise tax brackets as part of broader tax reforms or economic policies. These changes can alter income tax rates or redefine the taxable income ranges for each bracket.

Tax Reform Goals: Policy changes often aim to stimulate economic growth, simplify the tax code, or address income inequality.

Examples of Revisions: Expanding lower tax brackets to provide relief to middle-class taxpayers or increasing rates for higher-income earners.

Role in Tax Planning: Understanding these shifts is crucial for making informed decisions about investments and deductions.

How Tax Bracket Adjustments Affect Taxpayers

Changes to tax brackets influence the amount of federal income tax owed by individuals and families. Recognizing these adjustments is vital for effective tax planning and managing finances.

Key Considerations for Taxpayers

Income Thresholds: Adjustments can move taxpayers into different brackets, potentially lowering or increasing their tax liability.

Withholding and Refunds: Changes to income tax rates and brackets may require updating withholding amounts to avoid underpayment or overpayment during the year.

Impact on Deductions and Credits: Shifts in tax brackets can affect eligibility for certain deductions or tax credits, which are sometimes phased out at higher income levels.

Practical Steps for Tax Planning

Tax planning should account for periodic adjustments in tax brackets to ensure compliance and maximize savings.

Review Income Annually: Compare income levels against the latest tax brackets to anticipate potential changes in tax liability.

Adjust Withholding: Update W-4 forms with employers to match current tax rates and prevent surprises at tax time.

Leverage Tax-Advantaged Accounts: Contribute to retirement accounts or health savings accounts to reduce taxable income strategically.

4. Tax Brackets Can Benefit Low-Income Earners

Understanding tax brackets and their implications can provide valuable insights into how income tax rates are calculated, especially for low-income earners. A progressive tax system ensures that lower-income individuals pay reduced rates, alleviating their financial burden while supporting essential government services.

How Tax Brackets Work for Low-Income Earners

Tax brackets play a critical role in determining income tax rates, particularly for those in lower-income categories. This system ensures that income is taxed incrementally, with lower portions of earnings subject to the least tax burden.

Incremental Taxation: Tax brackets divide taxable income into segments, and each segment is taxed at its corresponding rate. Low-income earners only pay higher rates on amounts exceeding a specific threshold.

Lowest Brackets: The lowest tax brackets typically carry the smallest income tax rates, ensuring affordability for individuals earning below median income levels.

Benefits of Reduced Tax Rates for Low-Income Earners

For those in lower tax brackets, reduced income tax rates translate into tangible benefits. These advantages support both short-term financial stability and long-term opportunities for growth.

Increased Disposable Income: Lower tax obligations leave more funds available for essential expenses, savings, or investments. This is especially critical for low-income earners seeking to improve their financial situation.

Tax Credits and Deductions: Many tax planning strategies target low-income earners, including refundable credits or deductions, further reducing their tax liability.

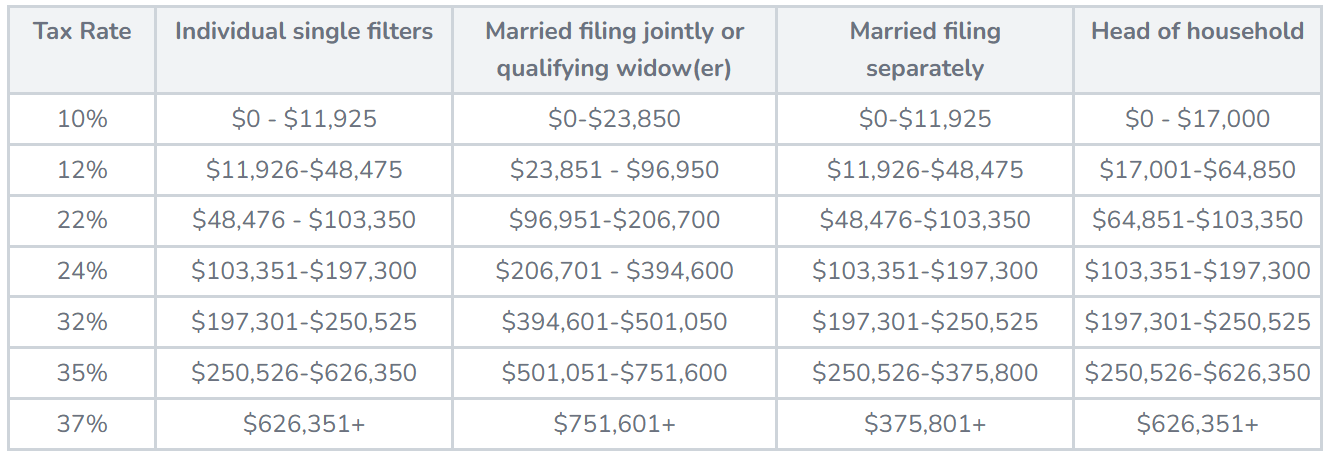

5. Tax Brackets Apply to Multiple Filing Categories

Tax brackets are essential components of the U.S. tax system, determining how much individuals owe based on their income. These brackets vary depending on the taxpayer’s filing status. Understanding these variations is key to effective tax planning and ensuring compliance with applicable income tax rates.

Filing Status Categories

Each individual falls into a specific filing status that influences their applicable tax brackets. These categories are designed to accommodate different life circumstances and ensure fair application of income tax rates.

Single Filers: This applies to individuals who are unmarried or legally separated at the end of the tax year. This category generally has higher income tax rates compared to joint filers at similar income levels.

Married Filing Jointly: Couples who are married and file a single tax return benefit from wider tax brackets, resulting in lower taxes on combined income.

Married Filing Separately: This option is for married individuals who choose to file separate returns. Tax brackets are narrower, and some deductions or credits may be limited.

Head of Household: Designed for unmarried taxpayers who pay more than half the costs of maintaining a home for themselves and a qualifying dependent. This status often features favorable tax brackets compared to single filers.

Qualifying Widow(er) with Dependent Child: Available to individuals whose spouse has died within the past two years and who have a dependent child. This category offers tax brackets similar to those for married filing jointly.

Impacts of Filing Status on Tax Brackets

Tax brackets are structured to address the varying financial situations of these filing categories. Adjustments are made to ensure fairness and proportional income tax rates.

Broader Brackets for Joint Filers: Married couples filing jointly enjoy wider tax brackets, allowing more income to be taxed at lower rates compared to single filers.

Head of Household Advantages: This status offers lower tax rates and higher standard deductions than single filers, recognizing the financial responsibilities of supporting dependents.

Limitations of Separate Filings: Married couples filing separately often face higher income tax rates and restricted access to certain tax benefits, making this option less advantageous in many cases.

Practical Tax Planning Considerations

Understanding how filing status affects tax brackets is critical for effective tax planning. Careful evaluation of personal circumstances can help taxpayers minimize their income tax rates.

Evaluate Joint vs. Separate Filing: Married couples should compare their potential tax liability under both filing jointly and separately to choose the most beneficial option.

Maximize Head of Household Benefits: Single parents or caregivers should ensure they meet the requirements for this status to take advantage of its favorable tax brackets.

Stay Informed About Changes: Tax brackets and filing requirements may change periodically due to legislative updates, making it essential to stay current with tax laws.

6 Key Factors to Consider When Choosing a Tax Planning Partner

Selecting the right tax planning partner is crucial to ensuring financial success and compliance with tax regulations. A professional and reliable agency can help navigate complexities, optimize tax strategies, and provide peace of mind. Below are the key factors to consider when making your choice.

1. Expertise and Specialization

The right tax planning partner should possess extensive knowledge and experience in tax laws and regulations. Their specialization in specific areas can significantly impact the quality of advice and services provided.

Qualifications: Look for certifications such as CPA (Certified Public Accountant) or EA (Enrolled Agent) to ensure they are qualified to handle complex tax issues.

Industry Knowledge: Agencies familiar with your industry or financial situation can offer tailored strategies that maximize benefits.

Up-to-date Expertise: Ensure the partner stays informed about the latest tax brackets, income tax rates, and legislative changes.

2. Comprehensive Services

A tax planning partner should offer a wide range of services to address all your tax-related needs.

Tax Strategy Development: Crafting customized strategies to minimize liabilities and optimize savings.

Compliance Assistance: Ensuring accurate filings and adherence to local, state, and federal regulations.

Year-Round Support: Providing guidance not only during tax season but throughout the year for proactive planning.

3. Transparency and Communication

Effective communication and transparency are critical to a successful partnership.

Clear Pricing: Understand their fee structure upfront to avoid unexpected costs.

Accessibility: Choose a partner who is readily available to answer questions and address concerns.

Proactive Updates: They should provide regular updates on changes in tax laws and their implications for your finances.

4. Reputation and Reviews

A tax planning partner’s reputation reflects their reliability and quality of service.

Client Testimonials: Read reviews and ask for references from past clients to gauge their performance.

Track Record: Evaluate their history of success in helping clients save money and achieve financial goals.

Professional Standing: Verify their standing with regulatory bodies and professional organizations.

5. Technology and Tools

The use of advanced technology can enhance the efficiency and accuracy of tax planning services.

Digital Solutions: Look for agencies that utilize secure, user-friendly platforms for document management and communication.

Data Security: Ensure they prioritize the protection of sensitive financial information.

Real-Time Insights: Tools that provide real-time tax projections and updates can improve decision-making.

6. Personalized Approach

Every individual or business has unique tax planning needs, and a one-size-fits-all approach won’t suffice.

Understanding Your Needs: The partner should take the time to assess your financial situation and goals.

Customized Strategies: Tailor-made plans that address your specific challenges and objectives.

Collaborative Process: Choose an agency that values your input and works with you to achieve the best outcomes.

Frequently Asked Questions

What are the penalties for late tax filing?

Failing to file taxes on time can result in penalties, typically a percentage of the unpaid taxes for each month the return is late. The IRS imposes a failure-to-file penalty of 5% per month, up to a maximum of 25% of the unpaid taxes. Interest also accrues on unpaid balances, increasing the total amount owed. Filing for an extension can prevent penalties but doesn't delay payment deadlines.

What is the difference between gross income and taxable income?

Gross income is the total amount of money you earn from all sources, including wages, investments, and other income streams. Taxable income, on the other hand, is what remains after deductions, exemptions, and adjustments are applied. Deductions such as retirement contributions, student loan interest, and health savings account contributions can significantly reduce taxable income. Taxable income is used to determine which tax bracket you fall into and how much tax you owe.

How do deductions and credits differ in reducing taxes?

Deductions lower your taxable income, which indirectly reduces the amount of tax you owe based on your tax bracket. For instance, if you claim a $2,000 deduction and are in a 25% tax bracket, your tax liability decreases by $500. Tax credits, however, directly reduce the amount of tax you owe, dollar for dollar. For example, a $2,000 tax credit reduces your taxes by the full $2,000. Some credits are refundable, meaning you can receive the remaining amount as a refund if it exceeds your tax liability.

What is the standard deduction, and who can claim it?

The standard deduction is a fixed amount that taxpayers can subtract from their income to reduce taxable income. It is available to all taxpayers who do not itemize their deductions. The amount varies based on filing status, such as single, married filing jointly, or head of household, and is adjusted annually for inflation. Taking the standard deduction simplifies tax filing and is beneficial for those whose itemized deductions fall below the standard amount. Certain groups, like the elderly or blind, may qualify for a higher standard deduction.

What are itemized deductions, and when should I use them?

Itemized deductions allow taxpayers to list eligible expenses, such as mortgage interest, state taxes, and medical expenses, instead of claiming the standard deduction. This option is beneficial if your deductible expenses exceed the standard deduction amount for your filing status. Itemizing can lead to substantial tax savings but requires detailed records and receipts. Common itemized deductions include charitable donations, property taxes, and unreimbursed medical expenses above a certain threshold. It often makes sense for homeowners or those with significant medical bills to itemize.

Simplify Your Tax Planning Today with Fincadia Tax Services!

Navigating tax brackets and income tax rates can be challenging, but Fincadia Tax Services is here to make it seamless for individuals and businesses in New York City. Our expert team specializes in personalized tax planning strategies to help you optimize your financial outcomes while staying compliant with ever-changing tax laws. Whether you're managing annual adjustments or planning for the future, our New York City-based services ensure you’re always a step ahead.

Let Fincadia Tax Services in New York City be your trusted partner in achieving financial clarity and success.

Want tax & accounting tips and insights?

Sign up for our newsletter.